Kaos Constructed, LLC

Welcome!

Bucket of Businesses:

7 Steps to 7 Streams of Income

Partner with a close-knit team of experienced mentors that will hold your hand through this step by step process, equipping you with the knowledge and tools necessary to become a thriving business owner with multiple streams of passive income.

Visit Our Website

Why are you here?

President & Founder

Devin Bryant

“These secrets have been well guarded for decades, but the truth is, anyone can access the benefits of the law when they know the language”

Navigating the digital landscape can be overwhelming, especially when financial gurus on social media bombard us with fragments of advice on credit repair, OPM (other people's money), entrepreneurship, and life insurance. It's like having puzzle pieces thrown at us without a clear picture in sight, leaving us more perplexed than informed.

But here's the silver lining – after a deep dive into the online realm, I've managed to piece together a comprehensive guide, the "Bucket of Businesses - 7 Steps to 7 Streams of Income." It's not your typical how-to manual; instead, it's a meticulously crafted roadmap born out of thorough research. What makes it stand out? The collaboration with seasoned mentors who bring tangible, real-world insights to the forefront.

STOP!

Caught you red handed..

People are searching for something or someone to save them & they’re being taken advantage of.

If you are looking for a hero, you have not found it.

Instead, you have found a path to self empowerment through education, decipline, and responsibility.

If those are big words for you, there are other programs for that.

The only

2 rules

RULE 1: EDUCATE YOURSELF!

We cannot help you succeed without the proper training and knowledge of the industry. This is a fully virtual mentorship, allowing you to access knowledge at your own pace. Just remember, time is money.

You don’t pay us to join, BUT this will require small self-investments of time and money along the way. Nothing is FREE but change.

If you aren’t quite ready to get started, no worries. Use the tools and links in this guide as a reference for the future.

RULE 2: APPLY ALL THE STEPS!

It is very important you APPLY all the steps to achieve success. This systematic process is tested and proven for those who apply the knowledge & principles.

Now, let’s talk about the steps.

The 1st one is our gift to you!

Step 1: FREE MONEY!

Unlock your 1st Stream of Income

We no longer want money to be the thing that holds you back.

Open a free merchant account & earn $500 a month for 6 months. That’s $3,000 Total GUARANTEED in 6 months, But you have to qualify.

This program is self funding. Upon Merchant approval, you will receive your first $500 payment to set the stage for your journey.

REQUIREMENTS:

Valid ID

3 Recent bank

Statements

2 Years Tax

Returns

600+ Credit

Score

Our partnered ecommerce program creates mutually beneficial e-commerce partnerships to connect you with online merchants at absolutely 0 cost to you.

100% Passive Income - Relax while we do the heavy lifting.

Although VantageScore credit scores have been around for 15 years, the FICO Score is still the preferred choice of 90% of lenders in the U.S. When you apply for a loan, credit card or some other type of financing, the lender will probably check your FICO Score.

Step 2: Debt Clense

From DAY ONE, we personalize this journey with Attorney Backed Credit Restoration, tailoring a comprehensive plan for you to strategically access $25k - $100k in 0% personal funding for a substantial 20-month period. This will provide you a unique window of opportunity.

A healthy personal credit score is vital, however, the credit repair process can be timely, and we need to get started!

Unlock the power of your profile

Beyond funding, a solid credit profile unlocks an array of opportunities.

Our Partnered Homeownership Program is a nationwide initiative to increase the homeownership rate to 75% for all Americans. We help aspiring homeowners achieve the dream of homeownership and affordable access.

Get & Give help:

DebtCleanse Agency

Embark on a rewarding career as a Mortgage Loan Officer, specializing as a Credit Education Advocate. Enjoy the perks of being a 50 State Federal Mortgage Loan Officer, acting as a RE Agent Referral Representative with lucrative referral commissions.

Unlock title earning opportunities, sales incentives, and access to legal plan services. Additionally, serve as a Home Warranty Representative, and become an equity owner in OwnEasy, complemented by enticing travel promotions and incentives.

unlock your 2nd & 3rd streams of income

Credit Advocate | Mortgage Loan Originator

DebtClense Agency

$399

One-time Setup Fee

$89.95

Monthly

Upgrade your DebtClense account to Agency status.

USE PROMO CODE EARLYBIRD2023 FOR A $150 DISCOUNT

Your credit repair is included with your one-time set up fee. Get your Agency Membership FREE when you register 5 people in your orginization.

Step 3: Life Solutions

This is where you come in..

Warren Buffet famously said - "my secretary pays more taxes than I do."

How could this be? Donald Trump said it best - "Because I'm smart."

Donald Trump was accused of not paying any taxes. Trump replied "That's because I'm smart." and that he takes advantage of the laws the way they are written.

THE QUESTION IS:

Why should these laws only apply to billionaires like Buffett or Trump?

THE TRUTH IS:

Although these secrets have been well guarded for decades, anyone can access the benefits of the law when they know the language.

Life Insurance is the first word in your new vocabulary.

IRS Tax Code 7702 allows certain life insurance plans to qualify for favorable tax treatment. Policies that qualify under the 7702 code enable the premiums paid into the policy to build cash to use as a tax-free loan if needed. This is the key element to becoming your own bank.

This will be your 3rd and most vital source of income.

Foundation Education

Life insurance is the gateway to financial solutions for the average American - Which is most likely you and most of the people you know.

- If you were to die, would you leave behind debt?

- Would your loved ones face financial hardship?

- Do you have dependents, own a small business or have a sizable personal estate?

Whether you’re deciding between basic coverage options, protecting your assets, interested in tax-free retirement, or establishing your own family bank, We are here to help you decide which plan best fits your needs, and is well within your budget. This will set the tone for a series of life policies you will utilize to become your own bank.

defining the industry

A license in the financial industry earns new, dedicated agents $80K - $100K+ in their first year. No 4 year degree, no expensive tuition. Just the cost of your state course to get started - $49.95 and a little dedication will go along way for you on this journey. Leveraging your license will be the driving force behind your future cash-flow in this program.

Continue at your own risk

The risk of failure in this mentorship is higher for those who do not take Step 2 and also choose a money path (DebtClense Agency or Life Agency), HOWEVER, if you’re already a business owner, with a substantial stream of income, and a 750+ credit score, let’s have a separate conversation...

Step 2: Restoring your personal credit is absolutely vital, but it can be timely. Consider your credit to be your financial reputation. we want the banks to know, like, and trust you.

Step 3: Securing your life license and/or Credit advocate/MLO agency is step 3. Educate yourself in the world’s leading financial industry. This will be the most substantial streams of income provided by this mentorship.

BONUS: You will naturally unlock 7 Stream of income as you go through the program. We’ll get there, I promise.

UNLOCK YOUR 4th STREM OF INCOME

Step 4: Personal Funding (the sweet spot)

Master the Art of Leverage Click to download our exact formula to maximizing funding.

Leveraging your fully restored credit profile will allow you access to $25k - $75k in 0% interest funding for up to 20 months, creating a unique opportunity to establish your business entity and fortify it’s foundation. We will develop a personalized plan to position your business to receive capital.

Credit Consultant

Life

Agent

Real Estate

(MLO)

Unlock access to our funding partners. Get paid to put money in your clients pockets. Our partners at NCC will nurture your clients into funding for you. Add additional funding advisors to your roster and create another powerful stream of passive income.

Step 5: Business Banking

Business entities provide a structured and credible framework that can attract investors, lenders, and venture capitalists. They show potential stakeholders that you are committed to running a legitimate and organized business.

Now that you have some personal momentum, starting a business empowers financial control, fostering independence, creativity, and the potential for long lasting success.

CLICK TO BUILD YOUR BUSINESS CREDIT INSTANTLY

Step 6: Business funding

Understand the crucial difference between personal and business credit when it comes to securing capital. Business owners access 5 to 10 times the amount of funding through a properly incorporated entity. This program will teach you the true concept of being a bankable business, and guide you through the steps to building a robust business profile. .

Exclusive Lender Relationships

Benefit from our unique connections with top lenders for favorable terms and a seamless borrowing experience.

Expert Advice from Business Advisors

Our seasoned business advisors provide strategic insights for informed financial decisions and successful outcomes.

Funding On Your Timeline

We work on your timeline, adapting to your business needs for a smooth and timely funding process.

Long Term Perspective With Every Client

Beyond transactions, we're committed to building lasting relationships, understanding your evolving needs for sustained success.

Step 7: Becoming the Bank

Indexed Universal Life

Generate, protect, and invest your money in the ways of the wealthy

crash course

Establish a family banking system offering a unique blend of financial security and compound growth, making it an attractive option for long-term financial liquidity and life-time retirement income. IUL Policy Holders are offered the dual advantages of protection and tax-free cash value accumulation.

Diversify your cash-flow will allow participations in an emerging affluent market requiring discretionary income to fund accounts at levels exceeding the minimum premium.

Knowledge grows like an investment, yielding a legacy beyond bank balances—a harmonious symphony of shared knowledge in your family to continue the legacy you started.

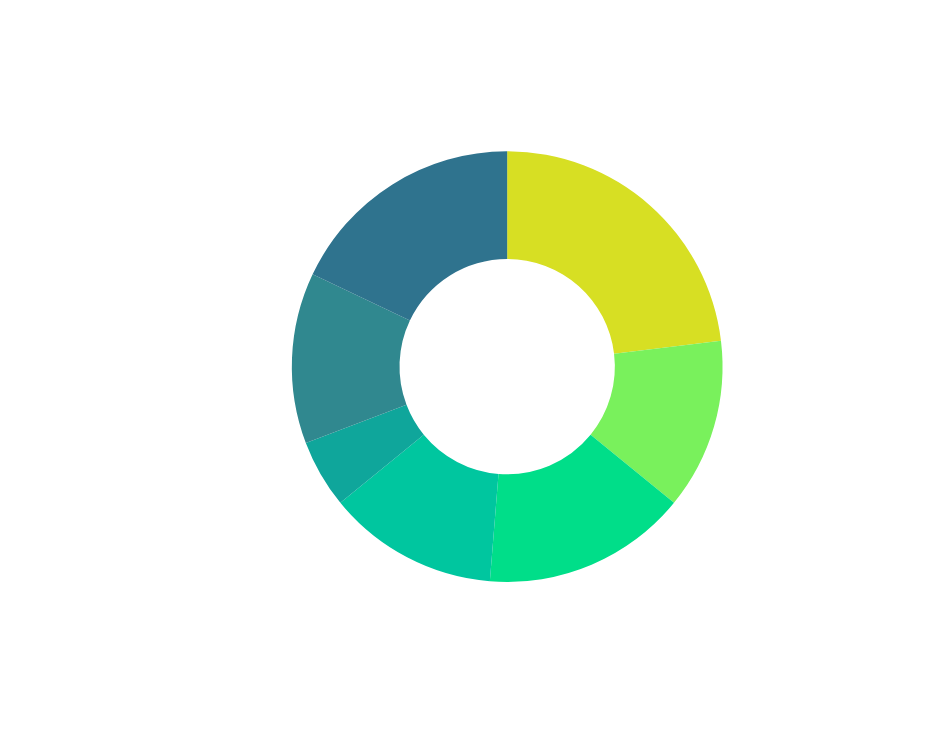

7 streams

of income

During this process you will naturally unlock the resources to becoming a thriving business owner with multiple streams of interconnected income. Dive into the 7 streams.

The 7 Steps of our mentorship are not random, but strategically combined to lead you to 7 Streams.

A lot of us are only missing a few pieces to the puzzle. We want to set you up with the full picture.

Can you see it?

7 STREAMS Roadmap

You will learn the basics by working through the Steps, Skill Blocks and Challenges while reaching Milestones along the way.

Get paid to put money in your clients pockets. Add other Funding Advisors to your roster and create another powerful stream of income.

Marketing Agency

Build a pipeline of affiliate marketing opportunities and fuel your business with Google, Facebook/ Instagram, & Youtube ad campaigns for traffic at every step.

GAME-CHANGING TECHNOLOGY & SUPPORT

With access to everything you need, & I mean everything – CRM, Funnels, Automations, Leads, Recruits, & High Level Expert Training, supported by 160+ back-office experts. Your time is yours to focus on making a difference – ensuring families get the protection they deserve while you lay the foundation for your future.

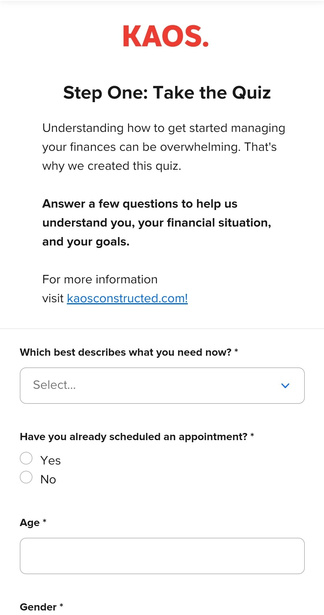

What is the process for partnering with KAOS?

- During your initial onboarding call, an agents will help you develop a personalized starting point of attack, no matter where you are on your journey. Take our 2-minute quiz to speak with an agent to discuss your goals, assess your long term needs, and review your profile.

- We believe we can help you a achieve levels of success in as little as 120 days. However, on average, we walk our clients through a step-by-step, 24-month process to long term wealth generation, financial security, and family protection. Building a legacy takes time.

What is involved in KOAS’ financial strategies?

- We provides you with a comprehensive and personalized wealth building strategy that starts with your goals and adapts to your changing needs. Your dedicated life coach is backed by an experienced team of specialists who cover key aspects of your financial life.

- With special focus on education, we utilize good credit, business incorporation, personal & business funding, & specialized life insurance vehicles to empower you to take control of your finances.

What’s the point?

Leverage.

The goal is to help you gain traction by generating a pipeline of earned income overtime, not get you rich over night.

Don’t quit your job, just yet. Even part-time agents earn $2,000 - $4,000 a month while we position them for funding.

Leverage the streams to generate extra income

Leveraging your license could create and most substantial stream of income provided by this mentorship.

Leverage your credit for personal funding

Jumpstart your financial aspirations and supercharge your future savings.

Leverage your funding to establish your business

Managing business funding and becoming the bank requires a healthy stream of income. Pour into it!

Leverage your businesses to become the bank

Unlock a robust tool belt of sharpened instruments to build your legacy step-by-step.